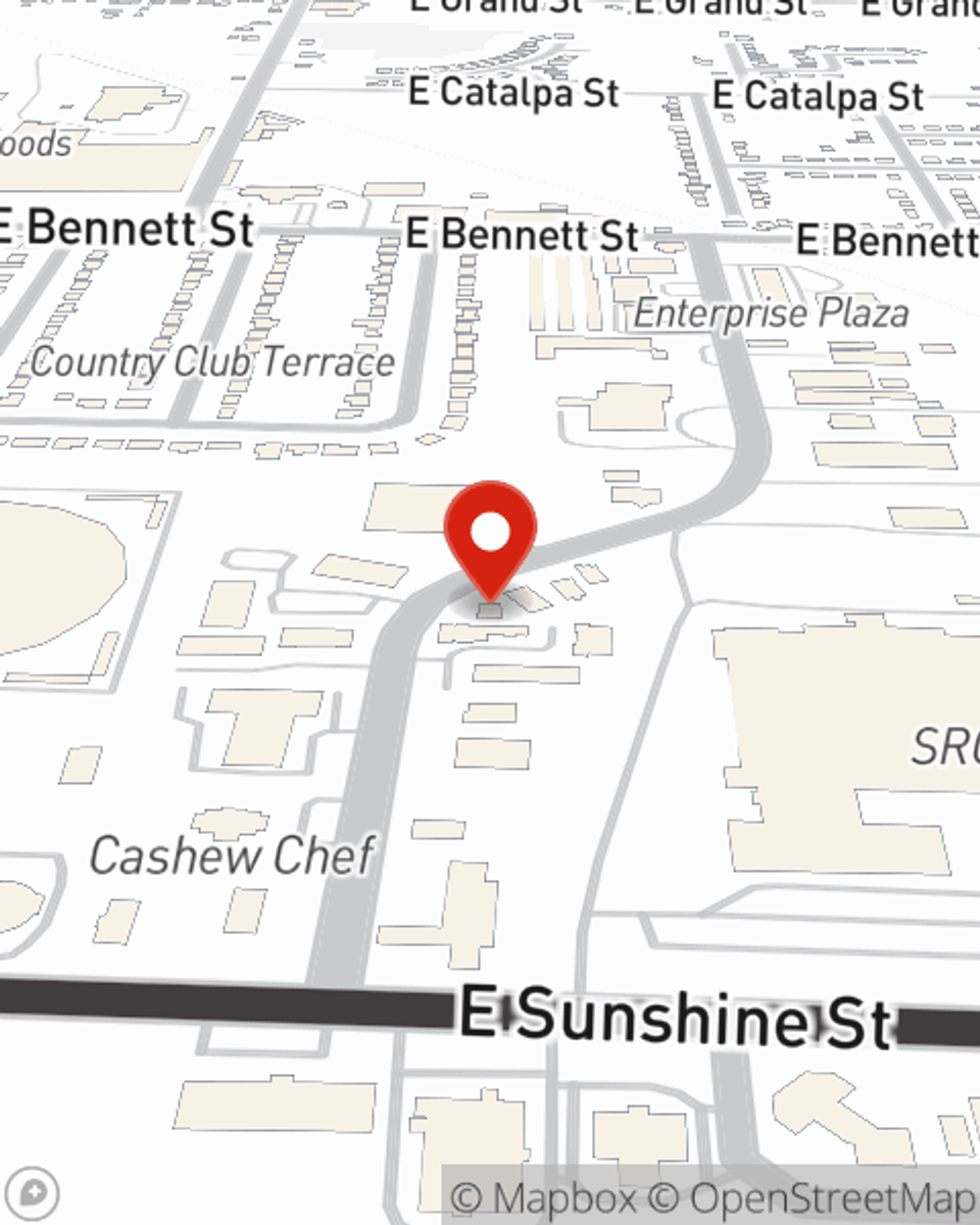

Auto Insurance in and around Springfield

Looking for great auto insurance around the Springfield area?

Let’s get this coverage on the road

Would you like to create a personalized auto quote?

Be Prepared For The Accidents Of Life

Everyone knows that State Farm has excellent auto insurance. From sedans to smart cars pickup trucks to SUVs, we offer a wide variety of coverages.

Looking for great auto insurance around the Springfield area?

Let’s get this coverage on the road

Navigate The Road Ahead With State Farm

But there are lots of ways to get where you are going and move from Point A to Point B. State Farm also offers insurance for truck campers, snowmobiles, trail bikes, golf carts and jet skis. Whatever you drive, State Farm has you covered in more ways than one with great savings options and attentive service. Plus, your coverage can be personalized, to include things like Emergency Roadside Service (ERS) coverage and rideshare insurance.

Auto coverage like this is what sets State Farm apart from the rest. State Farm is there whenever the unexpected happens to handle your claim promptly and reliably. State Farm has coverage options to get you wherever you are going from day to day.

Have More Questions About Auto Insurance?

Call Jim at (417) 882-3266 or visit our FAQ page.

Simple Insights®

Insurance and other tips for college students and their belongings

Insurance and other tips for college students and their belongings

Learn how your homeowners insurance policy can help protect your college student and their belongings while they are living in a residence hall or dorm.

How to safely sell a car in a few simple steps

How to safely sell a car in a few simple steps

Selling your car privately instead of to a dealership can be a good deal. State Farm has some tips to help you along the way.

Jim Roebuck

State Farm® Insurance AgentSimple Insights®

Insurance and other tips for college students and their belongings

Insurance and other tips for college students and their belongings

Learn how your homeowners insurance policy can help protect your college student and their belongings while they are living in a residence hall or dorm.

How to safely sell a car in a few simple steps

How to safely sell a car in a few simple steps

Selling your car privately instead of to a dealership can be a good deal. State Farm has some tips to help you along the way.