Business Insurance in and around Springfield

Looking for small business insurance coverage?

Cover all the bases for your small business

State Farm Understands Small Businesses.

When you're a business owner, there's so much to focus on. We understand. State Farm agent Jim Roebuck is a business owner, too. Let Jim Roebuck help you make sure that your business is properly covered. You won't regret it!

Looking for small business insurance coverage?

Cover all the bases for your small business

Protect Your Business With State Farm

State Farm has provided insurance to small business owners for almost 100 years. Business owners like you have counted on State Farm for coverage from countless industries. It doesn't matter if you are a fence contractor or an HVAC contractor or you own a book store or a fabric store. Whatever your business, State Farm might help cover it with customizable policies that meet each owner's specific needs. It all starts with State Farm agent Jim Roebuck. Jim Roebuck is the person who can relate to where you are firsthand because all State Farm agents are business owners themselves. Contact a State Farm agent to learn more about your small business insurance options

Reach out to the wonderful team at agent Jim Roebuck's office to identify the options that may be right for you and your small business.

Simple Insights®

Answers about automatic fire sprinkler systems

Answers about automatic fire sprinkler systems

Commercial sprinkler systems are a key step in fire protection. If you have questions, get answers to help protect your business from devastating fire damage.

Top reasons to add an accessory dwelling unit to your home

Top reasons to add an accessory dwelling unit to your home

Look at the rising trend of accessory dwelling units and check out tips to help you decide if one of these small homes is right for your big plans.

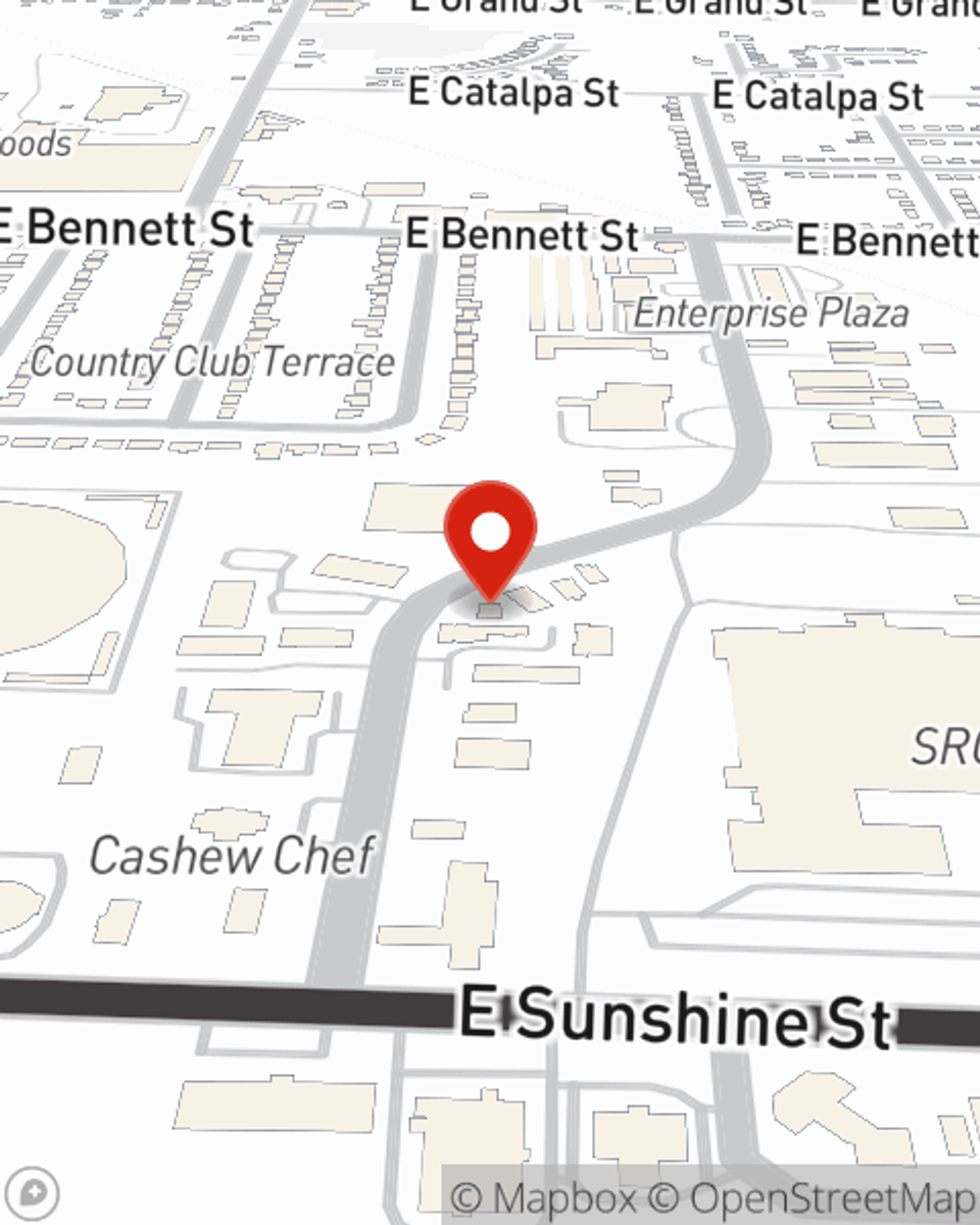

Jim Roebuck

State Farm® Insurance AgentSimple Insights®

Answers about automatic fire sprinkler systems

Answers about automatic fire sprinkler systems

Commercial sprinkler systems are a key step in fire protection. If you have questions, get answers to help protect your business from devastating fire damage.

Top reasons to add an accessory dwelling unit to your home

Top reasons to add an accessory dwelling unit to your home

Look at the rising trend of accessory dwelling units and check out tips to help you decide if one of these small homes is right for your big plans.